With bitcoin topping an unprecedented $2,400, LinkedIn Senior Software Editor Greg Leffler called bitcoin “the currency of criminals” in his video, “Bitcoin: What You Should Know“. This opinion was already outdated when LinkedIn Learning released my video series “Learning Bitcoin” three years ago. My “What is bitcoin” video from that course summarizes its history and then-current uses.

With that out of the way, I’d like to address a few of Mr. Leffler’s statements:

“Bitcoin is the currency of criminals”

He repeats variations of this throughout the two-minute video, along with sarcastic assertions that its legitimate uses pale by comparison. He lists its main uses as: to pay malware ransoms (although the recent worldwide “WannaCry” attack netted under $100,000 in bitcoin); to buy drugs (where? Silk Road and most of its bitcoin-fueled ilk have been closed for years); to buy fake I.D.s (same) and assassinations (same… also, probably only in his mind. If he has some figures showing how murderers are getting paid, I’d like to see them).

How do these “realistic” uses of bitcoin compare with the legitimate ones Mr. Leffler dismisses? It’s hard to find percentage figures for bitcoin sales, but some companies that accept payment in bitcoin include Steam ($3.5 billion gross revenue in 2015); Overstock.com (1.8 billion in 2016); and Newegg ($2.6 billion in 2015). If .000013 of their revenue comes from bitcoin, that beats the $100,000 number.

“Bitcoins don’t have any intrinsic value. It’s not a thing you can hold. It’s not worth anything in and of itself.”

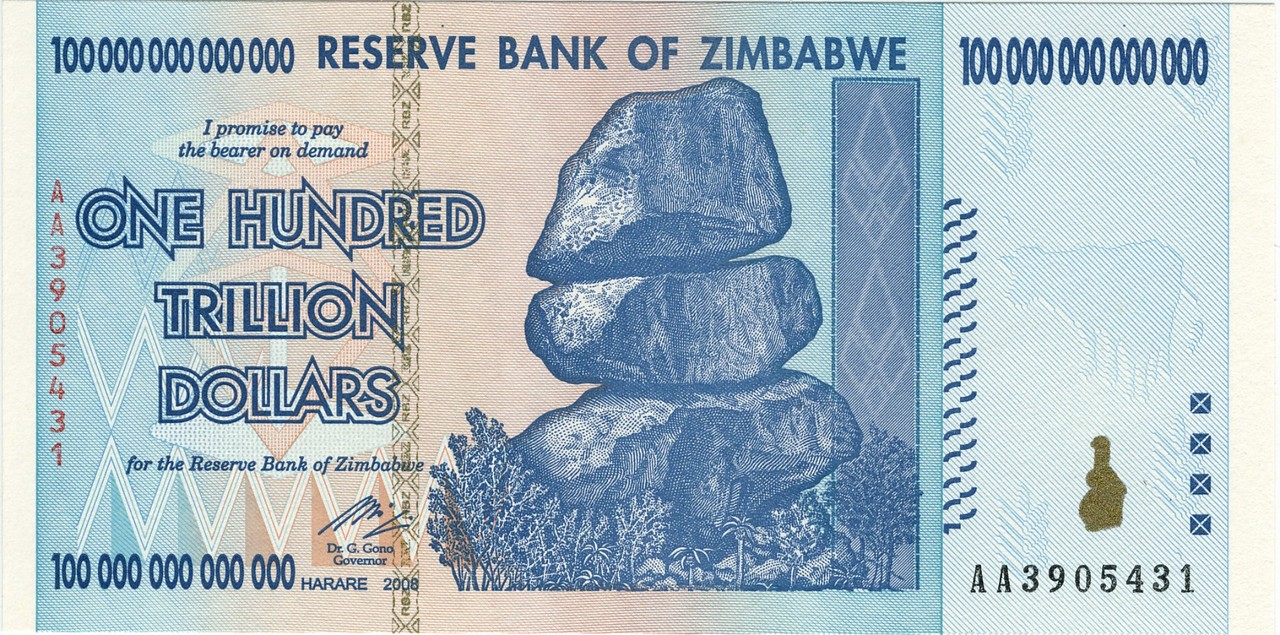

That… actually describes most financial instruments. All “money” (except commodity money) is based on the value that others will trade for it. And just because you can hold something, that doesn’t mean it has value. (I offer a stack of worthless hundred-trillion dollar Zimbabwean banknotes as proof.)

“Everybody promises that the blockchain is going to be the next big thing in technology… it’s not.”

Well, Mr. Leffler is a technologist, and he’s right that the blockchain (on which bitcoin’s security is based) hasn’t changed technology in a grand way. It’s introduced a relatively small idea into security tech… which has had triggered fundamental changes at the highest levels of government and corporate finance. Check out blockchain enthusiasm in the last few days from: the Monetary Authority of Singapore; Walmart; and Fidelity. An apt comparison is public-key cryptography, a small idea from the 1970s that now underlies damn near all online security.

“If you want to move any remotely large amount of bitcoin, it’s going to shift the market.”

Well, let’s look at the numbers. The total market value of bitcoin today is $60 billion. About 200,000 bitcoins (not 2,000, as he claims) went through exchanges yesterday, with a market value over $400 million. Just the top three largest transactions today have a value of $10 million — with no visible impact on the market. (And it’s only noon where I am!) Transactions of this size regularly get market value. How “remotely large” is he talking about?

Takeaway: Don’t take vaccine advice from actresses whose knowledge comes from discredited 20-year old studies. And don’t take bitcoin advice from technologists whose knowledge comes from 2010 news media.

Originally published at https://www.linkedin.com/pulse/what-bitcoin-really-four-ways-greg-leffler-wrong-tom-geller