Remember when one bitcoin cost only $450? I do.

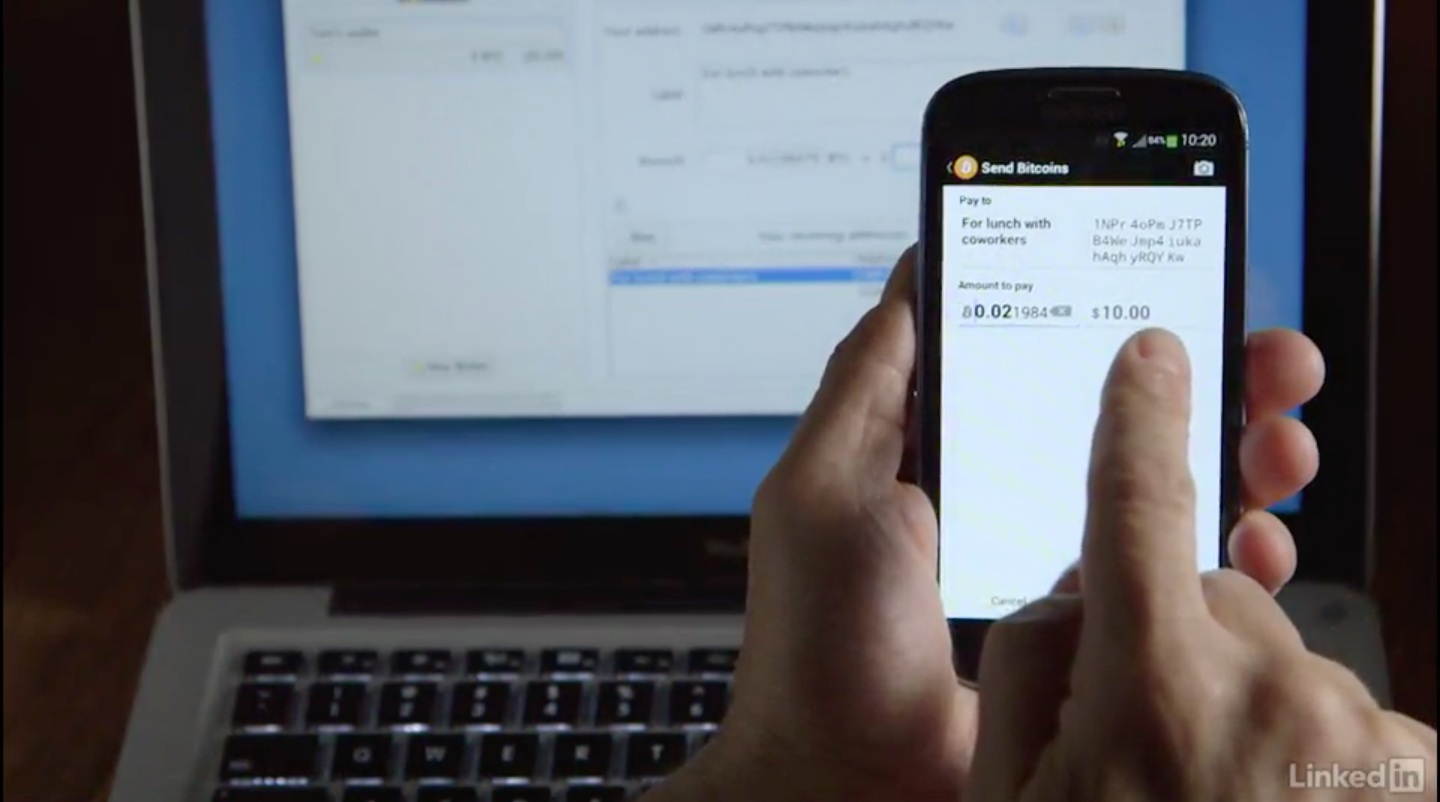

Four years ago, video training company Lynda.com published its first cryptocurrency course, my “Up and Running with Bitcoin“ (later retitled “Learning Bitcoin”). A lot’s changed in that time, so the company (acquired by LinkedIn Learning in 2015) asked me to revise it.

At first it was going to be a simple rework, but it quickly became clear that more was needed. So instead we just released a completely new, updated, and expanded course, “Learning Bitcoin and Other Cryptocurrencies“. It’s on LinkedIn Learning and Lynda.com; see it with a free month’s membership; here’s the intro video:

It’s fun to watch the original course, which is still on LinkedIn Learning and Lynda.com (although I doubt it’ll be there for long). Aside from increased market interest — which I’ll write about another time — here are some notable changes in bitcoin over the last four years:

- Bitcoin’s not the only game in town anymore. Well, in truth it wasn’t alone back in 2014, either: I personally held small amounts of the cryptocurrencies Litecoin and Dogecoin then as well. (I was a “Dogecoin millionaire” for the princely sum of US$200; a million Dogecoin now costs about $3,500.) But today there are over a thousand cryptocurrencies; a half-dozen have a market capitalization higher than bitcoin’s was then. While bitcoin’s market cap is still by far the biggest, it typically comprises only about 35-40% of the total for all cryptocurrencies.

- Cryptocurrency technology has expanded and diversified. Back then, the main difference among cryptocurrencies had to do with how it was mined — specifically, the cryptographic algorithm that secured the blockchain. But many coins these days don’t even use the (insanely wasteful) bitcoin-style “proof-of-work” system any more. Proof-of-stake, proof-of-time, sampling systems, hybrid solutions… the list is long. One of the cryptocurrencies I discuss in the course (IOTA) doesn’t use a blockchain at all, while another (Ethereum) has spawned an entirely new kind of cryptocurrency (ICOs) that rides on the back of its blockchain.

- Centralization, centralization, centralization. One of bitcoin’s greatest achievements is the creation of a security system with no single point of failure: No one company, bank, or government could shut it down. But like anarchy, decentralization is inherently unstable, as collectives band together to squeeze out small players. Nowhere is this clearer than in the world of bitcoin mining, where three pools (overwhelmingly Chinese) control enough power to topple the whole system, running hardware made by a small handful of (also Chinese) manufacturers. On one hand, centralization means errors (or greed, or malice) by a few people could cause big problems; on the other, it can give a cryptocurrency better convenience, liquidity, and popular acceptance.

- Cryptocurrencies have public acceptance — but not public use. The original bitcoin white paper criticized existing payment systems as unsuitable for “small casual transactions” because the transaction cost was too high. The irony is that a bitcoin transaction cost is now over a dollar, while it was about US$0.04 when I recorded the 2014 course. So the promise of being able to use it for ordinary purchases has mostly vanished, taking with it a big motivation for public interest. And yet more and more people have come to understand its foundations from repeated exposure to articles, news stories, and water-cooler conversations.

So what hasn’t changed?

While the bitcoin (and cryptocurrency) world is quite different from 2014, I would argue that it’s still not mature.

Cryptocurrency generally now share a quality that I saw in the early years of popular computers and the commercial Internet: It’s a solution in search of a problem. There’s still no “killer app” that compels ordinary people to convert their dollars, euros, and yen to them.

Many people claim to have such a solution — a list of initial coin offerings (ICOs) proves that. But nobody knows whether bitcoin or any other cryptocurrency will find its VisiCalc, its Google. (I suspect the popular breakthrough will be something silly, like Cryptokitties… or the traditional vehicles for the technological leading edge, porn and gambling.)

A year before recording the 2014 bitcoin course, I wrote some bitcoin predictions for Slashdot.org. You can judge how well they turned out overall. But one in particular was absolutely right: “Bitcoin is not the end game.” Let’s check back in 2022 to see whether any current cryptocurrencies were.

###

Tom Geller (tomgeller.com) is a writer and videojournalist with feet in The Netherlands an the U.S..